26 Ago Can you invest in art? We release new service in autumn

The value of art

A question that surrounds the head of any profane to the art market is why a work is worth millions and another apparently the same is worth nothing. Sometimes the answer is easy if we are asked about a name like Picasso, Basquiat or Warhol, but when we are asked about two works by the same artist or two contemporary artists and the same artistic period, the answer becomes more complex; it would be simplistic to say that “a work is worth what a buyer wants to pay for it” or that “the market adjusts the price of a work”. Michael Findlay, in The Value of Art, helps us with a professional answer: “The price of art is governed by supply, demand and marketing”.

Courtesy of Sotheby´s

And he adds: “To reach the market price of a work there are five attributes to know and weigh: provenance, condition, authentication, exposure and quality”. To culminate that perfect storm that determines the value of a work Findaly explains that the prices of a particular artist can be revalued by the work of a gallery, auction houses or art fair.These 3 players, together with the collectors themselves who call themselves mega collectors, are able through advertising and marketing campaigns to raise the status of certain artists. The Value of Art was published in the first edition in 2012 but its main concepts are still valid or even more accurate.

Art as an investment

Speculation or interest in art as a mere market for financial transactions is not a recent phenomenon, there is literature on the France of the great gallery owners where tricks are explained to increase the value of certain artists through tricks and games of supply and demand. The first great story about investment in art is coined under the label «L´Peau de l´Ours», name taken from a fable by Fointane, it is easy to know the story of the financial innovator André Level who in 1904 convinced twelve friends to buy among all works of young artists of his time among which were Gauguin, Picasso, Monet, Matisse. They acquired a total of 150 paintings and ten years later they were auctioned jointly getting a return on investment of four times what they paid, in honor of Level it must be said that they distributed 20% of the profits with the artists themselves. For some it was the first investment fund in known art.

Art and finance in the 21st century

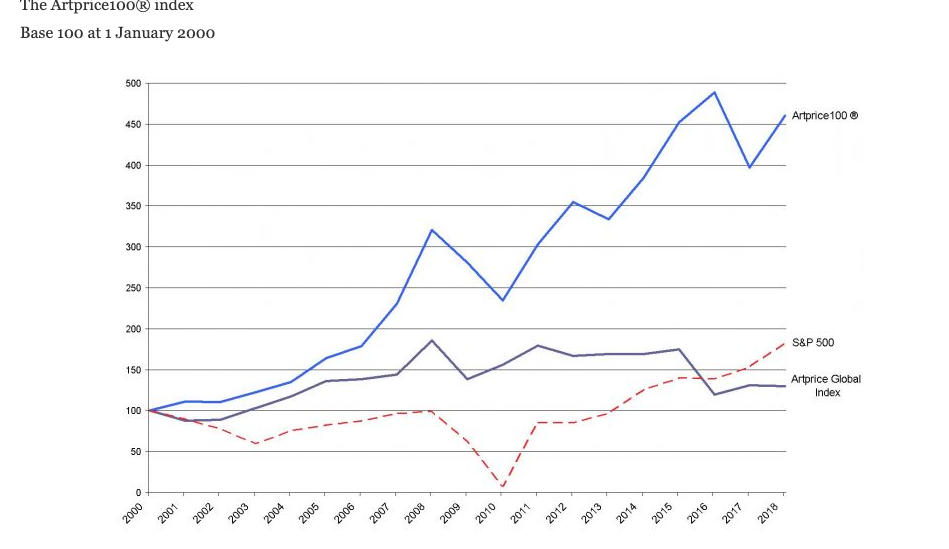

Going into the 21st century, mature countries such as the United States and United Kingdom have been considering art for decades as a financial and, almost investment, product that wealth managers, bankers, investors, investment funds resort… looking for a stable alternative to well-known products and a diversification of heritage. During the late twentieth century and throughout the twenty-first several indexes such as the Times-Sothebys Art Index, Mei Moses or now The Artprice100® index provide quantitative data on the performance of different artists and compare them with indexes known as the SP 500, also Deloitte publishes every year a report called Art & Finance Report where it identifies art as an asset to invest and from which there is already enough information to discern that art, especially contemporary art, is an “asset” that in times of stock market uncertainty can take of trouble and have a good exchange value.

If we look at the Artprice index from 2000 until now we see that the profitability of art runs in parallel to the SP 500, but if we look only at the 100 most profitable artists then the profitability of these artists is well above that of the 500 companies more profitable We return to the question of the title: Is it possible to invest in art?

Do you want to invest in art with The Art Market?

- Access investment opportunities advised by experts.

- Being more informed about the market prices of artists.

- They worry about the commissions of galleries and auction houses.

Based on these needs of our own clients we are working on a service that we will soon tell you more, for now, those readers who are interested in buying art and investment can subscribe to a specific list to access investment opportunities.

No Comments